economypedia

Public finance is refer to the all of government’s activates related to the management the mulating and implementing the financial policies for the country.

The main components of public finance include activities starting with implementing a financial strategy , collecting revenue(Tax,fees etc.), ends with spending the money in different government programs, such as social programs, education, and infrastructure in a way that reflects the financial and economic objectives of the country, particularly improving living standards and increasing levels of economic growth.

The cash or cash-equivalent that yields of liquidating a project or selling an investment. The Abandonment value process is important consideration for the investors and companies during the project to evaluate the profitability of project and decided whether is the project not profitable but has also incurred costs. The rule which used to make this decision caled net present value (NPV). A project is useful if the present value of all future net cash flows is greater than its abandonment value; otherwise the project is retired or sold prior to the end of its useful life.

The action of relinquishing all title,rights of claims to an asset or property completely and intentionally by the legally owner to a next owner.

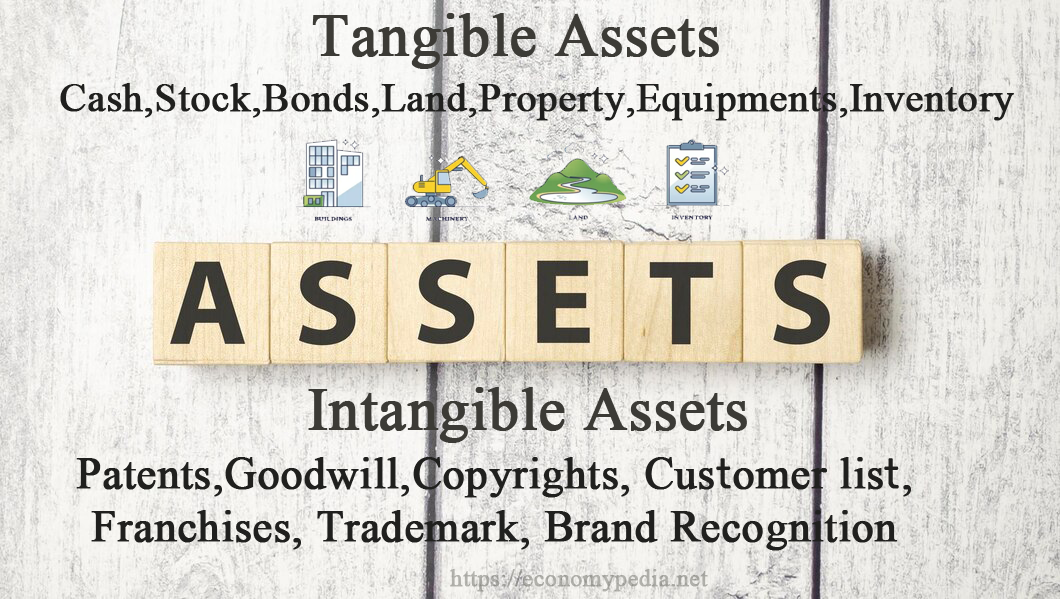

The abonnement could be with the tangible assets for example:

And for the intangible assets such as:

Elements of Abandonment

1. Act- abandonment must be done actually, through physical manifestations and not merely verbal or mental.

2. Intention- the intention to abandon must be present. It must be voluntary and not forced.

Ribawi items six substances goods which are sold by weight and by measure. The items are specified as followings:

- Gold

- Silver

- Wheat

- Dates

- Salt

- Barley

Exchange of these items of the same basis and of the same kind (i.e Gold with Gold ) it must be in the same weight and measurement with immediate of possession transfer ( القبض Qabdh ).

While the exchange of the Ribawi items of the different kind of the same basis (i.e Gold with Silver) the different of the weight and measurement and number of units are allowed, however the possession transfer ( القبض Qabdh ) is a must to be immediate .

Finally the exchange of the Ribawi items of the different kind of the different basis (i.e Gold with Dates) the different of the weight and measurement and number of units are allowed, however the possession transfer ( القبض Qabdh ) could to be immediate on spot or deferred .

These rules in exchange the Ribawi items In order to avoid the (Riba al Fadhl ربا الفضل ) which occurred because of exchange unequal amounts (measures and weights) of same kind and same basis Rabawi items . As well as avoiding (Riba al Nasiah or Riba Yad ربا النسيئة )

Gharar refer to an arabic terms of (الغرر ) which is mean unknown, risk, uncertainty or hazard that might lead to destruction or loss.

something which its consequence is undetermined.Hanafi scholars

anything that the end result is hidden or the risk is equally uncommon, whether it exists or not.Al-Sarakshi

it refers to any transaction of probable items whose existence or characteristics are not certain, due to lack of information, ignorance of essential elements in the transaction to either party.

Due to the uncertainty and risk involved, it makes a transaction similar to gambling. which is the main reason behind the prohibition of gharar.

The rationale of prohibition of gharar is to ensure full consent and satisfaction of the parties in a contract. Without full consent, a contract may not be valid.

Full consent can only be achieved through certainty, full knowledge, full disclosure and transparency.

There are two types of Gharar:

- Gharar Yasir (light or minor uncertainty)

- Gharar Fahish (excessive or major uncertainty).

Both forms of gharar are not haram. Gharar Fahish is the haram kind of Gharar. Gharar Yasir is under the halal class of Gharar.

Maisir (Maysir) refer to an arabic term ( ميسر ) which is a game of chance (Gambling) was played by arab before islam.

The Maisir (Maysir) arises when one party profits at the expense (loss) of the other, in an uncertain event. Earnings through it have been strictly forbidden by Sharia (the islamic law).

Gambling and all games of chance have been strictly prohibited by the Quran.

“They question thee about strong drink, and games of chance. Say: In both is great sin, and (some) utility for men; but the sin of them is greater than their usefulness.” (Al-Quran 2:219)

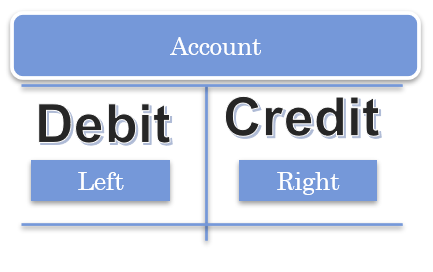

Credit (Cr) is a fundamental accounting entry that used to increases the accounts of Liabilities and Equity, or to decrease Assets and Expenses.

It is positioned to the right side in an accounting entry. On other hand, debit (Dr), positioned to the left side in an accounting entry and work to balance of the accounting entry.

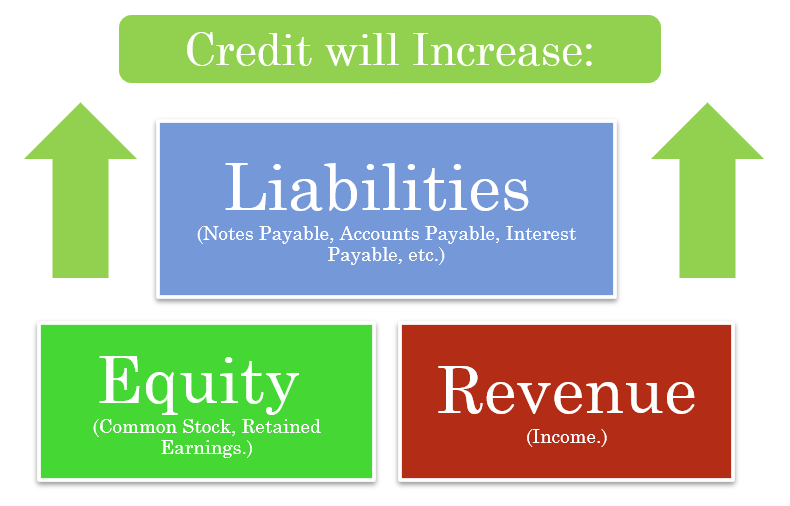

Credit will increase these accounts:

- Liabilities (Notes Payable, Accounts Payable, Interest Payable, etc.)

- Equity (Common Stock, Retained Earnings)

- Revenue (Income).

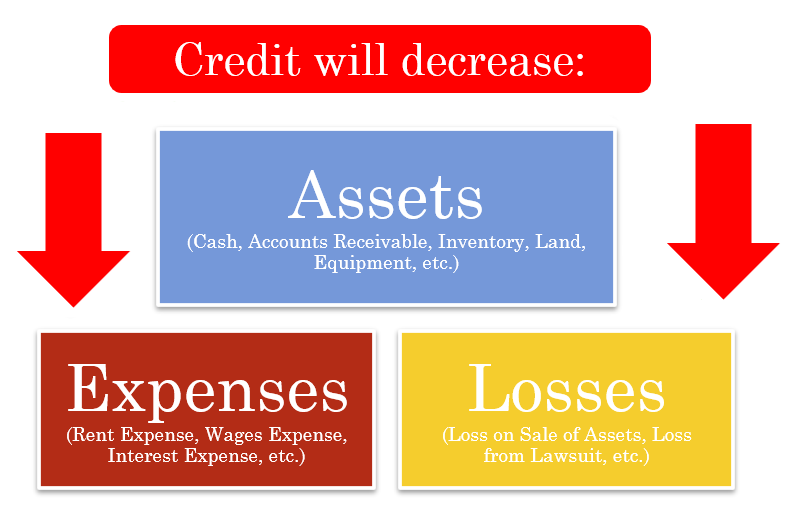

On other hand Credit will decrease these accounts:

- Assets (Cash, Accounts Receivable, Inventory, Land, Equipment, etc.)

- Expenses (Rent Expense, Wages Expense, Interest Expense, etc.)

- Losses (Loss on Sale of Assets, Loss from Lawsuit, etc.)

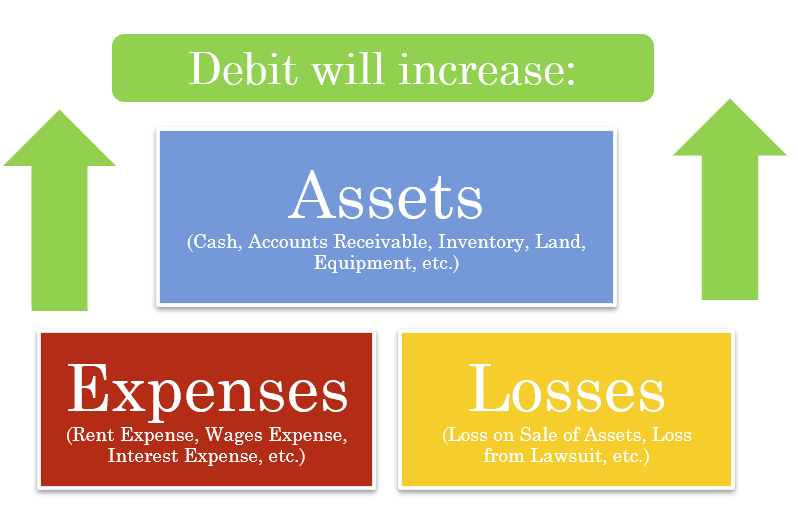

Debit (DR) is a fundamental accounting entry that used to increases the accounts of Assets and Expenses , or to decrease Liability and Equity accounts.

It is positioned to the left side in an accounting entry. On other hand Credit (CR), positioned to the right side in an accounting entry and work to balance of the accounting entry.

Debit will increase these accounts:

- Assets (Cash, Accounts Receivable, Inventory, Land, Equipment, etc.)

- Expenses (Rent Expense, Wages Expense, Interest Expense, etc.)

- Losses (Loss on Sale of Assets, Loss from Lawsuit, etc.)

On other hand Debit will decrease these accounts:

- Liabilities (Notes Payable, Accounts Payable, Interest Payable, etc.)

- Equity (Common Stock, Retained Earnings)

- Revenue (Income)

Gold prices drops after hawkish comments from Federal Reserve officials

Gold prices drops after hawkish comments from Federal Reserve officials hinted that the aggressive interest rate procedures will continue in the coming period in order to reduce the inflation.

Gold fell in spot transactions 0.20 percent to $ 1790.40 an ounce by 20 00 GMT, after it jumped to its highest level since the fifth of July after the release of consumer price index data in the United States.

While gold futures fell 0.3 percent to $1,806.50 an ounce.