Finance

Corporate Finance refer to all the financial activities related to running a corporate, including the funding and the actions that management takes to increase the value of the company. Basically, it deals with the daily financial activities that is required to achieve the corporation growths goal, such as planning, raising, investing and monitoring of finance.

Public finance is refer to the all of government’s activates related to the management the mulating and implementing the financial policies for the country.

The main components of public finance include activities starting with implementing a financial strategy , collecting revenue(Tax,fees etc.), ends with spending the money in different government programs, such as social programs, education, and infrastructure in a way that reflects the financial and economic objectives of the country, particularly improving living standards and increasing levels of economic growth.

The cash or cash-equivalent that yields of liquidating a project or selling an investment. The Abandonment value process is important consideration for the investors and companies during the project to evaluate the profitability of project and decided whether is the project not profitable but has also incurred costs. The rule which used to make this decision caled net present value (NPV). A project is useful if the present value of all future net cash flows is greater than its abandonment value; otherwise the project is retired or sold prior to the end of its useful life.

The action of relinquishing all title,rights of claims to an asset or property completely and intentionally by the legally owner to a next owner.

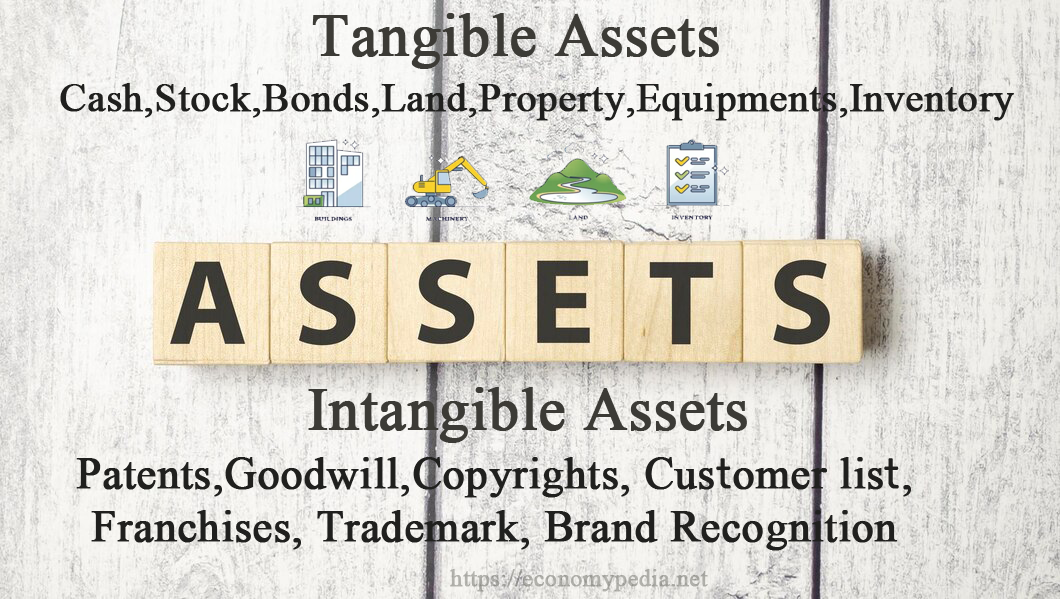

The abonnement could be with the tangible assets for example:

And for the intangible assets such as:

Elements of Abandonment

1. Act- abandonment must be done actually, through physical manifestations and not merely verbal or mental.

2. Intention- the intention to abandon must be present. It must be voluntary and not forced.

Finance as a term defined as the management of the money. It is involved all the activate related to the money such as investing, borrowing, lending, budgeting, saving, and forecasting.

There are three main categories of the finance:

A financial transaction involves an activity that changes the value of the assets, liabilities, or owner’s equity in a business. Almost everyone is involved in a financial transaction at some point or another. Examples of typical financial transactions include;

- Purchases at the candy store

- Buying a new house

- Paying monthly bills

Types of Financial Transactions

Any transaction that impacts monetary value and account balances is a financial transaction. They are recorded in accounting journals. Such events are important to investors, managers, businesses, and consumers. So what are the different types of financial transactions that these stakeholders record or engage in? There are four primary types of financial transactions in the business world. They include;

- Sales are financial transactions that legally transfer property for money or credit. Sales are a part of revenue that is earned by the business when goods are delivered or when services have been rendered to customer. Sales financial transactions made by extending credit to the customers would be recorded as accounts receivables.

- Purchases are financial transactions that involve the business obtaining the goods or services necessary to make sales. Purchases may be made with cash or using accounts provided by the supplier of the goods or services. This type of financial transaction is recorded in the accounts payable of the business.

- Receipts are the financial transactions caused by the business getting paid for supplying goods or services to another business.

- Payments are the financial transactions that refer to a business paying to another business for receiving goods or services.